Summary: The blog explores how AI app development is transforming the sports industry by enhancing performance analysis, transforming fan engagement, and improving the decision-making process. It also explains advancements in predictive analytics, personalized fan experiences, and the role of AI in injury prevention, etc. Artificial Intelligence technology has evolved over a few years, and it […]

How to Develop a Fintech App for iOS and Android that Breaks all the Rules

![]() By Nidhi Desai | Thursday, August 18, 2022 01:40 PM | 10 min read | 1855

By Nidhi Desai | Thursday, August 18, 2022 01:40 PM | 10 min read | 1855

Table of Contents

Financial technologies are undoubtedly part of the dynamic that sees many company domains improved by overall technological advancement. Digital solutions are used by banks, insurance organizations, and trading platforms to streamline operations and improve client interactions. It is hardly surprising that more individuals are downloading financial apps and that the fintech sector is expanding quickly.

The situation in fintech has also been impacted by the pandemic. As soon as people adopted digital technology, they realized that dealing with money wasn’t always personal. It makes sense that individuals began to ask how to create a fintech app given the growing use of technologies in the financial sector.

Building a fintech app can be extremely time- and labor-intensive to develop, especially if you want to make something distinctive. The good news is that development can be made simpler with the correct strategy and software.

To develop a fintech app requires incredible time and effort, especially if you want to create something unique. The pleasing news is that with the right approach and software development kit (SDK), you’ll be able to achieve your terminus much more quickly and easily than you might have thought possible. With this guide, we’ll teach you how to build fintech app for iOS and Android that breaks all the rules for traditional financial applications, as well as go over the steps involved in creating such an app from scratch! Let’s get started!

What Is Fintech?

Fintech is short for financial technology. Financial Technology (Fintech) is any app on the web or mobile that aims to enhance and streamline the delivery and utilization of finance services.

It assists businesses, companies, bankers, and other organizations manage their financial operations using specialized applications and algorithms that can be utilized on smartphones or computers.

It came into existence at the turn of the 21st Century, and initially, it was restricted to back-end systems used by established financial institutions. The concept has now changed to more customer-centric solutions. It now includes a variety of sectors like education, retail banking and investment management, the stock market, and more.

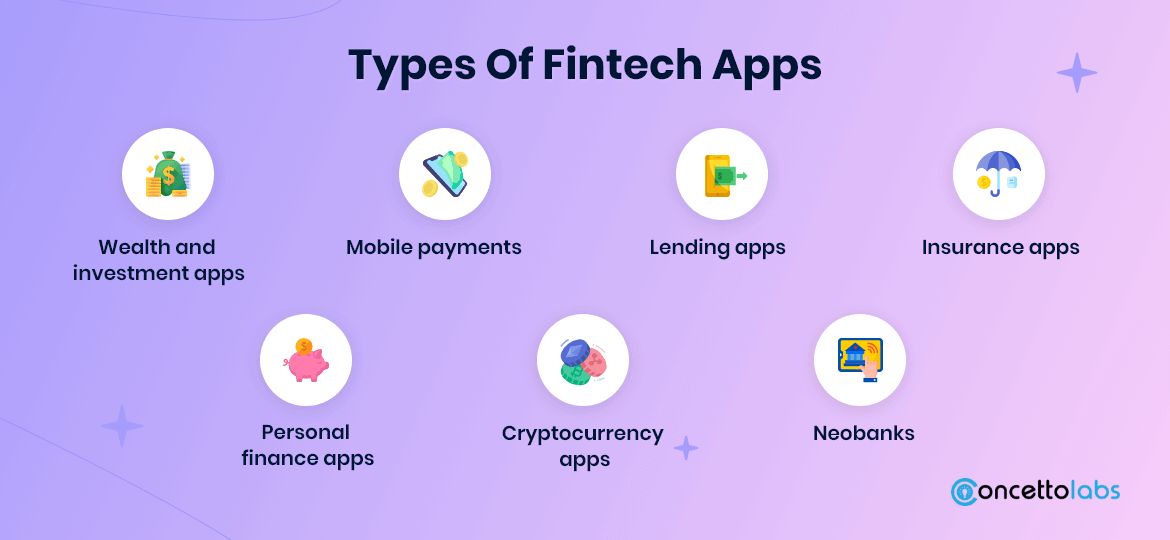

Types Of Fintech Applications

- wealth and investment apps

- mobile payments

- lending apps

- insurance apps

- personal finance apps

- cryptocurrency apps

- neobanks

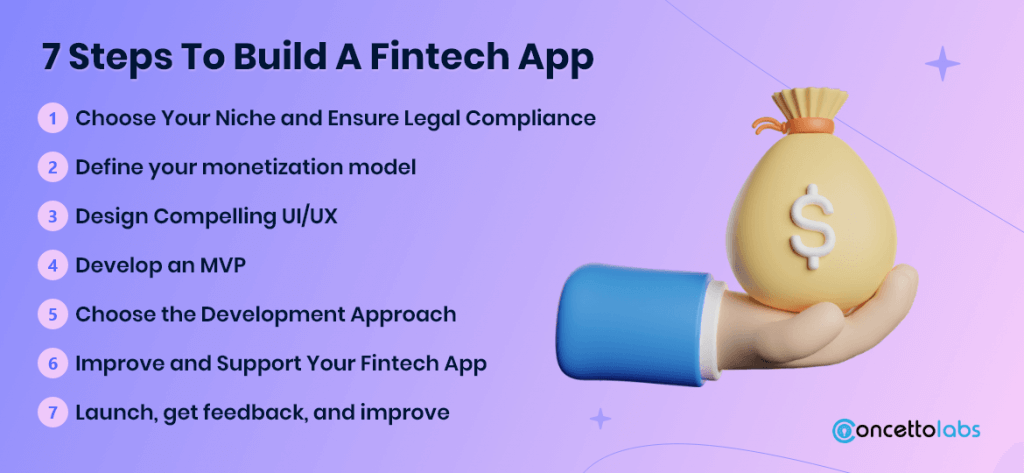

7 Steps To Build A Fintech Mobile App

1. Choose Your Niche and Ensure Legal Compliance

If you’re thinking about developing a fintech app, the first step is to choose your niche. There is a profusion of different areas you could focus on, from payments to investing to personal finance. Once you’ve decided on your niche, it’s important to ensure you comply with all the relevant regulations. It can be a complex process, but it’s essential to avoid any legal trouble down the road.

2. Define your monetization model

To make money from your app, you’ll need to monetize it. There are a few different ways to do this, but the most common is through in-app purchases. You can also offer subscriptions, advertising, or paid downloads. Whichever method you choose, ensure it aligns with your overall business model and doesn’t alienate your users.

3. Design Compelling UI/UX

When it comes to fintech application development, UI/UX is key. Your app’s interface should be clean, sleek, and easy to use. Good fintech apps have a few things: they’re fast, efficient, and secure. Consider these three things when designing your app’s UI/UX.

Your app’s color scheme should be professional yet eye-catching. Font choice is also important; use a clean, sans-serif font for easy readability.

Consider using icons and illustrations to add visual interest and help guide users through your app’s interface.

4. Develop an MVP

A minimum viable product (MVP) is an early version of your application with minimum features. However, the functionality must be sufficient for your users to test the application.

Launching an MVP first allows companies to experiment with various aspects without major expenses while simultaneously getting the biggest bang for their buck. Furthermore, this approach leaves ample opportunity for continual adjustments before launching the final product.

5. Choose the Development Approach

After forming your vision, you must select a suitable technology platform and team layout. The tech stack is directly connected to your system’s specifications and the project’s complexity.

Furthermore, your choice of technology will be based on:

- App functionality;

- Scalability and flexibility requirements;

- Market timing;

- Requirements for the load on the system;

- Platforms (web, native, or hybrid applications);

- Security needs;

- Goals of automation (for applications based on AI).

For the structure of the team, the structure of your team is greatly affected by the same technology factors we’ve already mentioned. If your app has intermediate to advanced functions, your team of developers is required to devote more time to creating the system. In contrast, simpler solutions are easier to build and require fewer resources.

6. Improve and Support Your Fintech App

Fintech mobile app development is not easy. It carries a lot of hard work, dedication, and creativity. The development process doesn’t go out when the release of your product comes around.

Maintenance of your application is equally crucial to make sure your application is user-friendly and competitive. Because the fintech industry constantly changes, routine maintenance tasks are crucial to keeping up with the changing technological and user needs.

7. Launch, get feedback, and improve.

When you’re ready to build your fintech app, get feedback from early users and use that feedback to improve the app. If you’re developing applications for budgeting, payment apps or an innovative insurance application, or any other kind that is a financial program, the likelihood of completing it in the first go is fairly low.

Software development is a very variable process, so be prepared to review the project repeatedly to make improvements and optimize.

Don’t be scared to break the rules regarding fintech app development – sometimes, creating a truly innovative product is necessary.

Cost to build a Fintech App?

There isn’t a precise estimate that applies to all applications. The absolute cost will be based on the cost drivers listed below:

- Complexity and functionality of your application.

- Platforms (iOS, Android, or both);

- Type and quantity of integrations;

- Animations and dashboards

- Innovative features (blockchain, AI, and other features) and more.

- At ABC, we’ve created fintech applications that fall within various cost ranges.

If you’re attempting to figure out how to build a fintech app and not overspend, we suggest starting with your MVP first. The MVP can help you make plans for future development budgets as well as gain an understanding of the core capabilities.

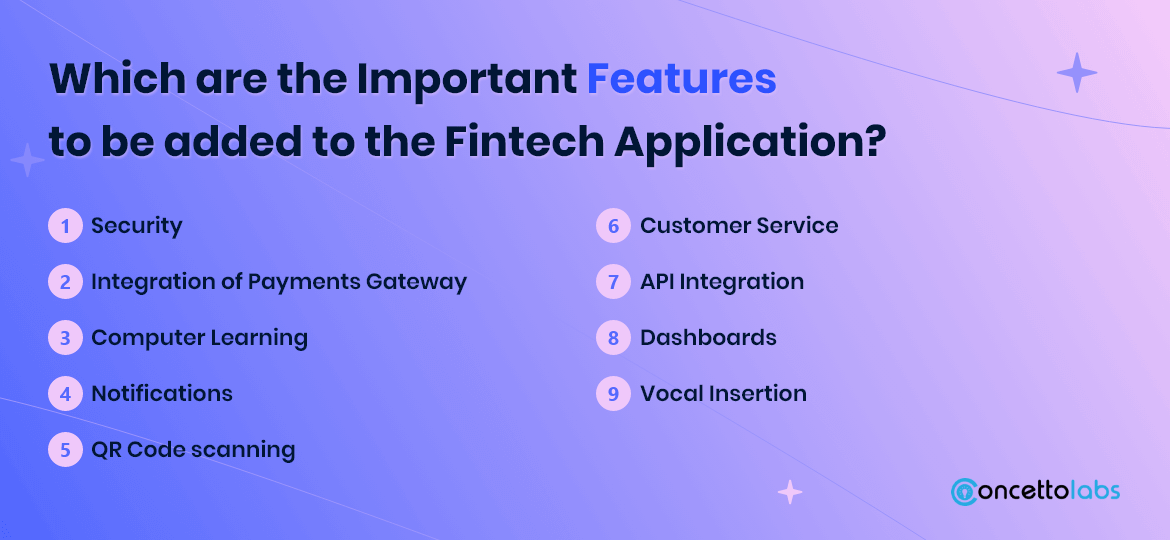

Which are the Important Features to be added to the Fintech Application?

People have specific expectations from new participants because there are currently many financial solutions available. To create a solid Fintech application, one does not need to overcrowd it with novel concepts.

One of the things you worry about when you want to create a fintech app is how well it will be welcomed. You need to add the following features to your application if you want to create a financial app that the audience will enjoy:

1. Security

Any fintech application must abide by security standards that safeguard users’ financial information. A fintech developer uses data obfuscation, encryption, blockchain, biometric and two-factor authentication, and other security methods to accomplish this.

2. Integration of Payments Gateway

Most fintech applications relate to payments. You can link with services like Stripe, PayPal, Zelle, or use bank APIs to enable payment capabilities.

3. Computer Learning

By this point, AI in financial apps is no longer an optional feature but rather a requirement. Machine learning algorithms collect data from a variety of sources, analyze it, and then offer recommendations.

4. Notifications

A positive user experience and notifications are closely related when it comes to apps. Users appreciate personalized user experiences and learning about the latest app features and special offers. The benefits of notifications, in turn, include boosting conversions, increasing retention, and tracking user analytics.

5. QR Code Scanning

Give customers the option to simply scan the digits rather than enter them, which would save time. Managing financial operations this way is more practical and error-free. Customers were able to withdraw cash by scanning a QR code from an app at Wintrust and FIS ATMs in 2015. According to their estimation, such a withdrawal takes 8 seconds.

6. Customer Service

Apps are typically used by businesses and individuals when they require something. Make sure a live chat or support option is available 24/7. Some people are comfortable conversing with other people, while others are not. Provide a chatbot option for those who aren’t. If you combine these features, you can create an easy-access customer support system that is trustworthy.

7. API Integration

Application Programming Interface (API) knowledge is a requirement. Without that, it is difficult to create an app. Fintech uses this technology to combine many platforms of a huge application, eliminating the need for them to continually rebuild themselves. You, the end user, might not be aware that Fintech can incorporate a fresh web form or SaaS by utilizing the same ecosystem. API is the technology at work behind the scenes when you click on Geolocation to find the closest ATM. Additionally, API is responsible for the thorough AML/KYC procedures.

8. Dashboards

A fintech application today would be difficult to envision without some sort of visual representation, whether it be stock charts, spending history, or payment history.

9. Vocal Insertion

Fintech apps developers may decide to leverage voice assistants like Siri, Google Assistant, and Bixby to present their most commonly used features to users. With that strategy, users continue to use the app without really opening it.

Cost to Build Fintech Application

Because each solution will vary from the others in terms of requirements, scalability, and feature set, it is difficult to determine the precise fintech development app estimate. Location and hourly rate of the team are also important.

The price of producing your app will entirely depend on the number of features you imagine, whether you choose to create a mobile site or smartphone app, and whether blockchain development will be used in your app. The longer it takes to develop and the bigger the development estimate, the more integration it will demand.

We can, however, provide you with an estimated average cost for a financial platform.

Topflight Apps has worked on banking apps that have cost up to $160,000 to develop from start to finish (both iOS and Android). However, we also created cool MVPs for $30,000 in total. The following, alone or in combination, will have the largest negative effect on your fintech app’s development budget if it lacks an AI component

- Connecting all API integrations to the back-end business logic of the app

- Implementing animated, highly interactive dashboards

Before designing your app in full, we always advise beginning with a prototype to test the idea. Once you receive input from actual customers who have used the prototype, many of the features might be changed. Thus, you have the advantage of maintaining control over the development budget.

Get in touch with our professionals to develop a Fintech App for every platform

What are the Challenges Faced in Product Development?

You must consider several risks even though your fintech solution has the potential to be a huge success. You can make a plan to deal with them or avoid them if you are aware of them.

1. Legal guidelines

Governments actively monitor the fintech sector since it deals with a lot of delicate and private information that comes from a large number of people. Additionally, every nation has rules that businesses must abide by. Therefore, ensure that your future solution complies with all regulatory standards, including international ones, before beginning the creation of your financial app.

2. Competition

The fintech market’s newest participants confront fierce competition. Your competitors will also include Big Tech businesses like Google and Apple, in addition to the nearly daily emergence of small and medium-sized startups and conventional banks. They have introduced financial solutions, and because their customers are devoted, their products are successful. Therefore, you should provide something more convenient and distinctive if you want to win the trust of your potential users.

3. Maintenance of Security

Security has already been brought up multiple times, but it bears repeating. Your main priority must be security. All forms of cybercrime should be prevented from accessing data. If an attack is successful, it may result in million-dollar losses, a damaged reputation, and months or even years of rehabilitation.

Try our FinTech app development services and get secured experience!

Why Use payment solutions apps?

There are many benefits to adopting payment solution apps. Let’s look at a few of these advantages to get a sense of what online payment solution apps are all about.

1. Improved Cash Flow

Who doesn’t want quick cash flow, right? This is advantageous for the bank as well as the clients. Every party involved in a transaction is aware of every stage of the procedure thanks to the aid of Fintech mobile app development. Never before has checked in and out been so simple.

2. Reduced Costs and Workforce

Payment solution apps can be quite beneficial for small enterprises. Small businesses and start-ups can save a lot of time and money by eliminating surcharge fees, and bank transaction expenses, and hiring employees to monitor transactions, among other things.

3. Increased Popularity of the Brand

Nowadays, it’s nearly impossible to identify a millennial without a smartphone. Smartphones are now the ultimate marketing hub for businesses thanks to their incredible popularity.

4. Retail Demands

The demand for a brand’s products increases when it becomes well-known. The majority of payment solution apps are user-friendly, which increases their appeal for use among a wide audience.

Conclusion

On-demand fintech app development is the future of banking. By offering your customers the ability to access their finances through an app, you can provide a level of convenience and customer service unmatched by traditional banks. But, is not without its challenges. To succeed, you will need to have a strong understanding of the fintech landscape and adapt quickly to market changes. But, if you are ready for the challenge, on-demand fintech app development can be extremely rewarding financially and professionally.

We must all acknowledge that the transition from conventional payment methods to online payment solutions is inevitable. Online payment options reduce time and money spent, and Fintech mobile apps might be one of the greatest answers to all of your online financial needs. Modern cybersecurity is available with user-friendly, low-maintenance fintech apps. To build fintech software without coding you can contact our developers to guide you through the procedure would be your best option.

Table of Contents